The Biden administration has announced the cancellation of $9 billion in student loan debt for an additional 125,000 borrowers. These borrowers were already eligible for debt cancellation

through various programs, including Public Service Loan Forgiveness, income-driven repayment plans, and discharges for those with disabilities. The debt forgiveness is seen as an effort to address issues within the student loan system.

The $9 billion in debt forgiveness breaks down as follows:

$5.2 billion for 53,000 borrowers who worked for at least a decade in eligible public service fields, such as teaching or the military.

Nearly $2.8 billion for nearly 51,000 borrowers through adjustments to income-driven repayment plans, who had been in repayment for two decades or more and reached the forgiveness threshold.

$1.2 billion for nearly 22,000 borrowers with permanent disabilities identified through a Social Security data match.

These actions by the administration come as student loan payments resume for millions of borrowers after a more than three-year hiatus during the pandemic. Some borrowers have coincidentally met the criteria for loan forgiveness, while others had faced bureaucratic obstacles that prevented them from receiving the relief they were entitled to until now.

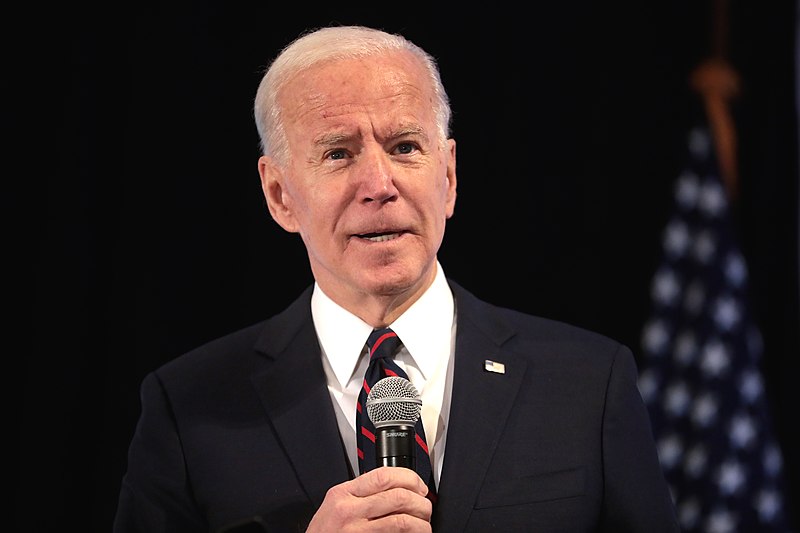

The forgiveness measures follow previous announcements made since June when the Supreme Court rejected President Joe Biden's original plan to provide up to $20,000 in loan forgiveness for most borrowers. While the comprehensive relief plan was blocked, the administration has been able to address student loan debt on a smaller scale.

The White House has reported erasing $127 billion in student debt for approximately 3.6 million Americans, with the recent 804,000 borrowers being among the beneficiaries. These borrowers had been making payments for over two decades but had not seen the promised loan forgiveness.

Other groups promised loan forgiveness include borrowers who were misled or defrauded by their colleges or attended schools that suddenly closed. In total, more than 40 million Americans carry student loan debt amounting to approximately $1.7 trillion.

Looking ahead, President Biden's administration is launching a second attempt at mass loan forgiveness. A committee composed of colleges, borrowers, state attorneys general, and student loan servicers will meet to discuss potential routes for large-scale student loan balance erasure. However, any proposal developed by this committee could take time to become reality and may be subject to change by a future administration.

In the interim, President Biden is encouraging borrowers to consider enrolling in his new income-driven repayment plan, known as Saving on a Valuable Education (SAVE). Under SAVE, borrowers with income below a certain threshold, determined by family size, may have their payments reduced to $0. Borrowers who were previously enrolled in another income-based option called Revised Pay As You Earn (REPAYE) were automatically transitioned, while others need to apply for this plan. Photo by Gage Skidmore from Surprise, AZ, United States of America, Wikimedia commons.