President Joe Biden has issued his first veto after Congress voted to block a Labor Department rule allowing retirement plans to weigh the long-term impacts of social factors and climate

change on investments. The move by Congress was described as a “woke” policy by Republicans and was seen as being harmful to the pockets of retirees. The legislation, which required only a simple majority to pass, was voted on by Senate Republicans along with two Democrats, Senators Jon Tester and Joe Manchin. President Biden argued that retirement plan fiduciaries should be allowed to consider any factor that maximizes financial returns for retirees across the country.

Environmental, social and governance (ESG) is an investing strategy that takes into account businesses’ environmental and social risks as part of a wider financial analysis. This approach is popular with major pension funds that invest the retirements of millions of workers as well as retail investors. However, Republican lawmakers and conservative advocacy groups have decried the ESG rule, calling it "woke". Florida Governor Ron DeSantis, who is likely to run for the 2024 GOP presidential nomination, has become a leader in the anti-ESG movement. Conservative states such as Florida, Texas, and West Virginia have launched investigations due to the rule, while right-wing donors have backed conservative advocacy groups in their campaigns against ESG in statehouses across the country.

The veto comes as part of a larger debate surrounding climate change and the role it should play in investing. The Labor Department rule allowed retirement plans to consider the long-term impacts of social factors and climate change on investments, a move that many believe could have helped to mitigate the negative effects of climate change on the economy. However, opponents argue that such considerations can hurt the financial returns of investors and retirees, a stance that has been criticized by proponents of ESG.

ESG advocates argue that climate change is a systemic risk that should be factored into investment decisions. Climate change poses a serious threat to the global economy, and investors who fail to take this into account could be left with stranded assets and other financial losses. In addition, ESG investing is seen as a way to promote social and environmental justice by incentivizing companies to adopt sustainable practices.

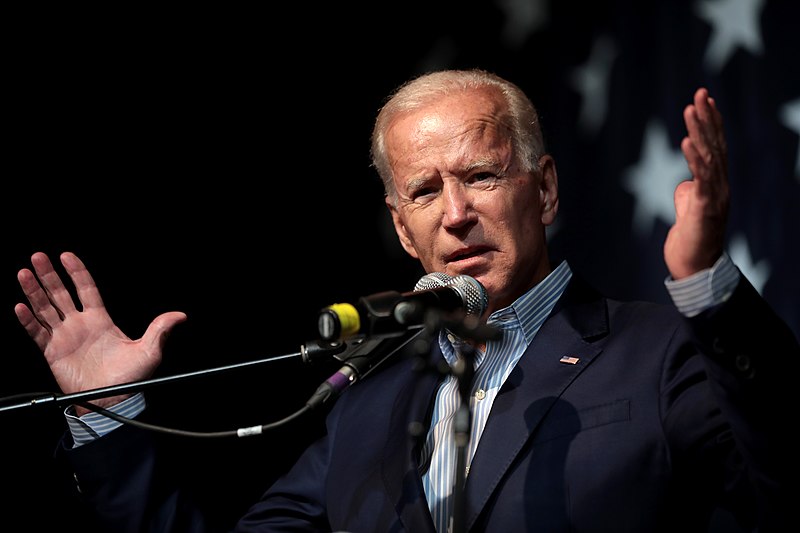

The veto by President Biden highlights the ongoing debate over the role of ESG investing in retirement plans and other investment vehicles. While some argue that ESG considerations can help to mitigate the negative effects of climate change and promote social and environmental justice, others argue that such considerations can hurt the financial returns of investors and retirees. As the world continues to grapple with the challenges posed by climate change, it is likely that the debate over ESG will continue to be an important issue for investors and policymakers alike. Photo by Gage Skidmore from Peoria, AZ, United States of America, Wikimedia commons.